Table of Contents

1. Definition of Technical Analysis in Stock Market

2. Softwares used for Technical Analysis

3. Tutorials for Technical Analysis

4. Technical Analysis Terms

5. Back Testing

6. Optimization

7. Data feed

8. Chart patterns and Technical Analysis of Commodities

9. Centaur Investing

10. Conclusion

1. Definition of Technical Analysis in Stock Market

In finance, technical analysis is a security analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. It automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of the stock market.The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis which states that stock market prices are essentially unpredictable.

What is Technical Analysis of Stocks?

|

| Technical Analysis plotted on charts |

Fundamental analysts examine earnings, dividends, new products. Technicians employ many methods, tools and techniques as well, one of which is the use of charts. Using charts, technical analysts seek to identify price patterns and market trends in stock markets and attempt to exploit those patterns. Technicians using charts search for archetypal price chart patterns, such as the well-known head and shoulders or double top/bottom reversal patterns, study technical indicators, moving averages, and look for forms such as lines of support, resistance, channels, and more obscure formations such as flags, pennants, balance days and cup and handle patterns cts, research and the like. Technicians apply many methods, tools and techniques as well, one of which is the use of charts. There are many techniques in technical analysis. Adherents of different techniques (for example, candlestick charting, Dow Theory, and Elliott wave theory) may ignore the other approaches, yet many traders combine elements from more than one technique. Some technical analysts use subjective judgment to decide which pattern(s) a particular instrument reflects at a given time and what the interpretation of that pattern should be. Others employ a strictly mechanical or systematic approach to pattern identification and interpretation.

2. Softwares used for Technical Analysis

Technical analysis softwares are available in the form of commercial or open source softwares. Such softwares may be available on a computer, or on a mobile phone or personal digital assistant . The available softwares that are available in the market include Metastock, Amibroker or MT4. Online technical analysis software packages provide access from any Internet-connected computer (including a suitably equipped mobile or PDA) but may require the user to store their information with the provider. Installed, downloaded software will only be available on the computers that the user has downloaded and installed it on. Nowadays these software are available in mobile phones which makes easier for the traders to trade and do technical analysis.

3. Tutorials about Technical Analysis

Many people think that technical analysis is only for traders and not for long term investors which is completely wrong. Technical analysis can also be used for longer-term investments and so let us explain technical analysis for longer-term investments to find the right time to invest in the right stock and at the right price.

Types Of Charts

The types of charts that are used in the field of Technical Analysis are the following:

- Candlestick chart – Of Japanese origin and similar to OHLC, candlesticks widen and fill the interval between the open and close prices to emphasize the open/close relationship. In the West, often black or red candle bodies represent a close lower than the open, while white, green or blue candles represent a close higher than the open price.

|

| OHLC Chart |

- Open-high-low-close chart – OHLC charts, also known as bar charts, plot the span between the high and low prices of a trading period as a vertical line segment at the trading time, and the open and close prices with horizontal tick marks on the range line, usually a tick to the left for the open price and a tick to the right for the closing price.

|

| Point and Figure chart |

- Point and figure chart – a chart type employing numerical filters with only passing references to time, and which ignores time entirely in its construction.

Chart Patterns to look for:

One of the major premises of technical analysis is that history repeats itself. For the technician the recurrence of identifiable patterns and formations that have preceded important movements of the market in the past provide important clues as to the probable direction of price movement in the future. Chart patterns are formations that appear on the charts which provide the technical analysts with forecasting tools of impending price movement. Some patterns are more reliable than others for price forecasting. None of the chart patterns are impeccable. They have a high probability of success but are not guaranteed to work all of the time. Technicians must always be on the alert for chart signs that prove their analysis to be incorrect. After trend lines, support and resistance lines have been drawn on a chart, one of the most important and most difficult decisions you will have to make is determining the timing of entering and exiting the market as well as determining when a major top in a rising market or a major bottom in a declining market has occurred.

There are two types of patterns that develop on charts, the reversal pattern and the continuation pattern. Reversal patterns indicate that an important reversal in trend is taking place. Knowing where certain patterns are most likely to occur within the prevailing trend is one of the key factors in being able to recognize a chart pattern. Some of the most common reversal patterns include; the head and shoulders top and bottom, double tops and bottoms, triple tops and bottoms, key reversals, island reversals, rounding bottoms and tops, "V" formations or spike bottoms and tops. There are a few important points to be considered which are common to all of these reversal patterns.

There are two types of patterns that develop on charts, the reversal pattern and the continuation pattern. Reversal patterns indicate that an important reversal in trend is taking place. Knowing where certain patterns are most likely to occur within the prevailing trend is one of the key factors in being able to recognize a chart pattern. Some of the most common reversal patterns include; the head and shoulders top and bottom, double tops and bottoms, triple tops and bottoms, key reversals, island reversals, rounding bottoms and tops, "V" formations or spike bottoms and tops. There are a few important points to be considered which are common to all of these reversal patterns.

1. The existence of a prior major trend is an important prerequisite for any reversal pattern.If a price pattern has not been preceded by an existing trend, there is nothing to reverse and the pattern would therefore be suspect. Knowing where chart patterns are most likely to occur within a price trend is one of the key factors in identifying price patterns.

2. The first signal of an impending trend reversal is often the breaking of an important trend line.The breaking of a major trendline signals a change in trend, not necessarily a trend reversal. The breaking of an uptrend line might signal the beginning of a sideways trend which may later form either a reversal or continuation pattern.

3. The larger the pattern the greater is the price movement potential.The height of the pattern measures the volatility, the width of the pattern measures the amount of time required to build and complete the pattern. The greater the height of the pattern ( the volatility ) and the longer it takes to build - the more important the pattern becomes and the greater the potential for the ensuing price move.

4. Topping patterns are usually shorter in duration and more volatile than bottoms.Price swings at major tops are wider and more violent. Tops usually take less time to form than bottoms. For this reason it is usually less risky to identify and trade bottoms than tops however the time spent in establishing a top is generally shorter than the time spent establishing a market bottom. Therefore, a market manager can generally do better by trading the downside of the market rather than the upside of the market. This has important implications for farm managers, due to the fact that the natural tendency is to trade the former rather than the latter.

5. Volume is usually more important on the upside Volume should generally increase in the direction of the market trend and is an important confirming factor in the completion of all price patterns. The completion of each pattern should be accompanied by a noticeable increase in volume, particularly at market bottoms. Market tops tend to fall on their own weight once a trend reversal is underway. Another difference between reversal and continuation patterns is their time duration. Reversal patterns usually take much longer to form on the chart and represent major changes in trend. Continuation patterns, on the other hand, are usually shorter-term in duration and are often classified as intermediate term chart patterns. Some of the most common continuation patterns include; flags, ascending and descending triangles, symmetrical triangles, pennants, gaps, and rectangles.

Knowing the Efficient Indicators for Technical Analysis

An in-depth introduction to the various kind of technical indicators and oscillators out there is given below:

|

| Indicators for Technical Analysis |

- Bollinger Bands - A chart overlay that shows the upper and lower limits of 'normal' price movements based on the Standard Deviation of prices.

- Chandelier Exit - A indicator that can be used to set trailing stop-losses for both long and short position.

- Ichimoku Clouds - A comprehensive indicator that defines support and resistance, identifies trend direction, gauges momentum and provides trading signals.

- Keltner Channels - A chart overlay that shows upper and lower limits for price movements based on the Average True Range of prices.

- Moving Averages - Simple and Exponential - Chart overlays that show the 'average' value over time. Both Simple Moving Averages (SMAs) and Exponential Moving Averages (EMAs) are explained.

- Moving Average Envelopes - A chart overlay consisting of a channel formed from simple moving averages.

- Parabolic SAR- A chart overlay that shows reversal points below prices in an uptrend and above prices in a downtrend.

- Pivot Points- A chart overlay that shows reversal points below prices in an uptrend and above prices in a downtrend.

- Price Channels - A chart overlay that shows a channel made from the highest high and lowest low for a given period of time.

- Volume by Price - A chart overlay with a horizontal histogram showing the amount of activity at various price levels.

- Volume-weighted Average Price (VWAP) - An intraday indicator based on total dollar value of all trades for the current day divided by the total trading volume for the current day.

- ZigZag - A chart overlay that shows filtered price movements that are greater than a given percentage.

4. Technical Analysis terms

The terms that are associated with Technical analysis are many. Some of them are discussed below:

Open - This is the price of the first trade for the period (e.g., the first trade of the day). When analyzing daily data, the Open is especially important as it is the consensus price after all interested parties were able to "sleep on it."

High - This is the highest price that the security traded during the period. It is the point at which there were more sellers than buyers (i.e., there are always sellers willing to sell at higher prices, but the High represents the highest price buyers were willing to pay).

Low - This is the lowest price that the security traded during the period. It is the point at which there were more buyers than sellers (i.e., there are always buyers willing to buy at lower prices, but the Low represents the lowest price sellers were willing to accept).

Close - This is the last price that the security traded during the period. Due to its availability, the Close is the most often used price for analysis. The relationship between the Open (the first price) and the Close (the last price) are considered significant by most technicians. This relationship is emphasized in candlestick charts.

Volume - This is the number of shares (or contracts) that were traded during the period. The relationship between prices and volume (e.g., increasing prices accompanied with increasing volume) is important.

Open Interest - This is the total number of outstanding contracts (i.e., those that have not been

exercised, closed, or expired) of a future or option. Open interest is often used as an indicator.

Bid - This is the price a market maker is willing to pay for a security (i.e., the price you will receive if you sell).

Ask - This is the price a market maker is willing to accept (i.e., the price you will pay to buy the security).

Time periods in moving averages-"Buy" arrows were drawn on the chart when a stock's price rose above its 200-day moving average; "sell" arrows were drawn when the stock's price fell below its 200-day moving average.

Time periods in moving averages-"Buy" arrows were drawn on the chart when a stock's price rose above its 200-day moving average; "sell" arrows were drawn when the stock's price fell below its 200-day moving average.

5. Backtesting

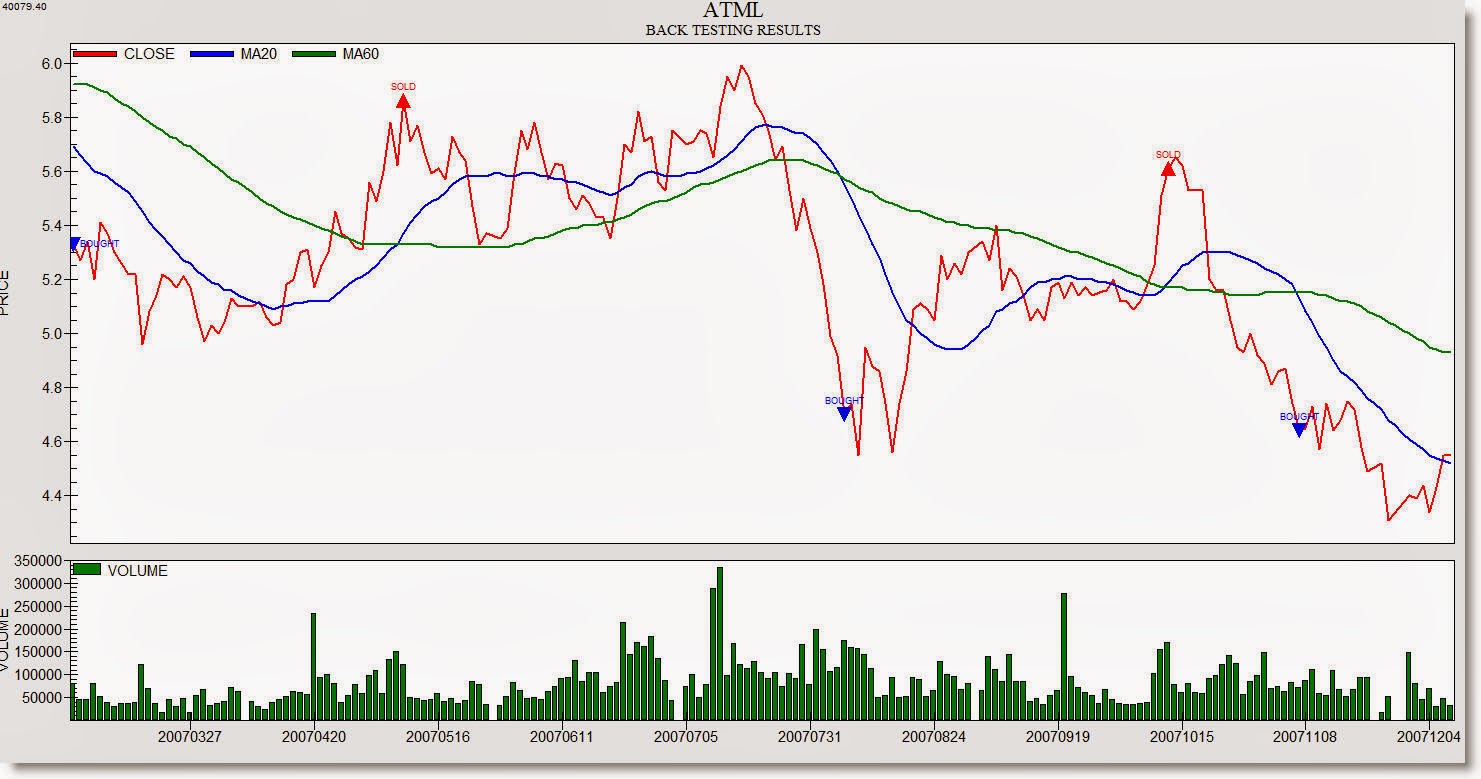

|

| Back Testing Results |

Systematic trading is most often employed after testing an investment strategy on historic data. This is known as backtesting. In the Stock market Back testing is most often performed for technical indicators, but can be applied to most investment strategies (e.g. fundamental analysis). While traditional backtesting was done by hand, this was usually only performed on human-selected stocks, and was thus prone to prior knowledge in stock selection. With the advent of computers, backtesting can be performed on entire exchanges over decades of historic data in very short amounts of time. Suitable softwares like Metastock and Amibroker and data providers like rtdsdata.com integrate the backfill data which are automatically loaded in the charting platforms for technical analysis.

6. Optimization

A process of testing technical analysis indicator parameters, with the view to developing an investment strategy that generates the maximum return based on historical price movement on the ongoing front line stocks. The optimization process is achieved through the fine-tuning of the associated technical analysis charting parameters. Typically technical analysis indicators have a range of parameters that can be adjusted, such as the interval period and the technical analysis indicator variables.

7. Data feed

Data feed is very vital for Technical Analysis as the technical analysts rely a lot upon the real time data feed provided by various data providers. Quality of data feed is the prime factor towards efficient technical analysis. By Quality it is meant that the data should be accurate, continuous( with no gaps or lost data), reliable and simple. Data Integrity should be maintained throughout every kinds of data like real time data, historical data, end of day data, intraday data etc. Traders and stock market enthusiasts should be very cautious while selecting the right data service provider. Modern days are having many new unscrupulous service providers who claim to be genuine service providers but in reality are not the same. However there are some exceptions like www.rtdsdata.com who really are striving hard in maintaining quality standard when it come to quality,. integrity and support services.

8. Technical Analysis Vs Fundamental Analysis

Technical Analysis

|

Fundamental Analysis

|

|

| Definition | Uses price movement of security to predict future price movements | Calculates stock value using economic factors, known as fundamentals. |

| Data gathered from | Charts | Financial Statements |

| Stock bought | When trader believes they can sell it on for a higher price | When price falls below intrinsic value |

| Time Horizon | Short-term approach | Long-term approach |

| Function | Trade | Investing |

| Concepts Used | Dow Theory, Price Data | Return on Equity (ROE) and Return on Assets (ROA) |

Vision

|

Looks backward | Looks forward as well as backward |

9. Centaur Investing

In ancient times the centaur's half human half animal composition represented the embodiment of mankind's struggle for civilized behaviour against untamed nature. Three thousand years later that struggle continues in many facets of life. Centaur Investment Management are continually striving for market beating returns through contrarian investment principles that deliver superior financial efficiency against the seemingly disparate forces that preside over financial markets.The disciplined and rigorous techniques employed by our highly trained and specialised professionals are complemented by the use of proprietary instruments that have allowed us to relentlessly pursue our multi strategy absolute return approach with extraordinary success.The battle as epitomized by the Centaur is always likely to exist in some form or other, but our experience is that by applying our mantra to all investment decisions, the informed and disciplined will always prevail.

10.Conclusion

It is hoped that this article has opened up the field of Technical Analysis to the reader and have ignited the interest of the reader in Technical Analysis so much so that the reader

would be spurred on by the new found interest to take further actions to learn and master Technical Analysis for their trading success.

|

| Technical Analysis is a Forecasting Tool |

Technical Analysis is an art form. What one does is more of a matter of personal preference and style. It is critical to use the tools that you are most comfortable with and that of which will match well your trading philosophy. Never forget Technical Analysis is just a forecasting tool. As with any other forecasts, it should be continually monitored, assessed and updated when new conditions appear. Never depend solely on a single tool to provide you with the trading signals as some will work better than others in different situations. Back testing and paper trading might be a good start to stress test any new trading systems before you actually take the plunge. And never forget a sound money management is just as critical if not more important than the Technical Analysis itself in any successful trading endeavor.